Our theory of change

Patamar invests in early-stage technology companies building sector-defining business models that transform the lives of the emerging middle class who are underserved in their access to basic products and services.

We invest in companies that help narrow the gap in the supply and demand of these basic products and services across six main investment themes, which are financial inclusion, SME digitization, agriculture, healthcare, education, and affordable housing.

We believe that technology is and will continue to be critical in unlocking economic opportunities for individuals and small businesses in Southeast Asia and can address current market linkage inefficiencies, enabling a level playing field driving inclusive growth in the region.

Our impact investment strategy

Our impact investment strategy

We invest in tech startups under two objectives:

Top-tier financial returns

We invest in solutions that are geared to generate risk-adjusted returns without the trade-offs of risk. These solutions reconcile and complement impact and investment returns.

Measurable positive social impact

The focus of our investments is to achieve positive outcomes for underserved populations. We assess and measure such impact over time and demonstrate intentionality.

Our approach

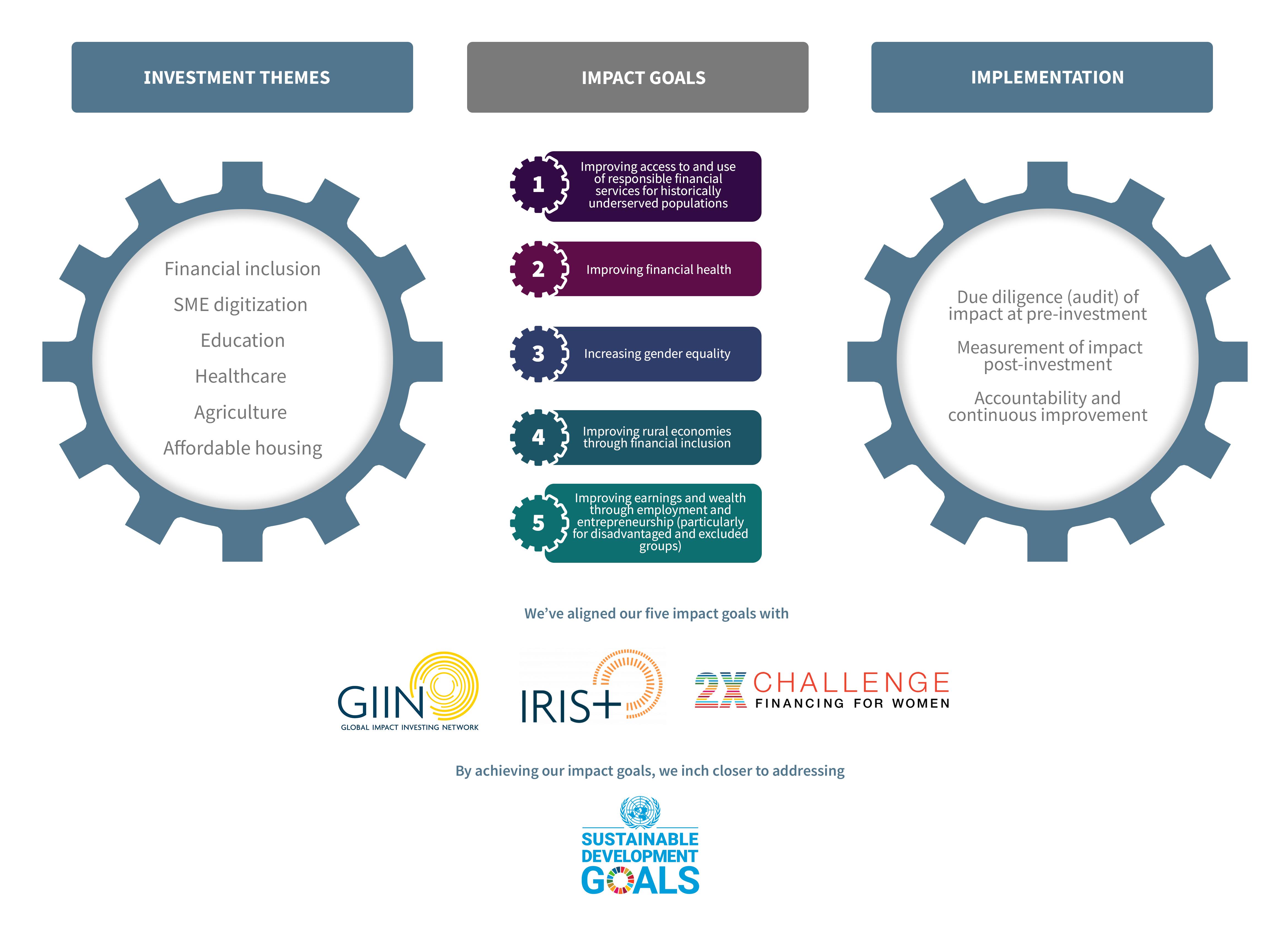

The diagram illustrates our approach to impact investment and measurement.

Our six investment themes have been aligned with the impact investment framework introduced by GIIN and IRIS+, which has helped identify five strategic goals of impact, in order to achieve our key indicators: UN SDGs (1, 3, 4, 5, 10), and the 2X Challenge.

Furthermore, the implementation of our impact investment strategy covers:

- Audit and approval of impact investment

- Assessment of impact post-investment

- Accountability and continuous improvement of the impact assessment process

Our approach

Our approach

Investment themes

- Financial inclusion

- SME digitization

- Education

- Healthcare

- Agriculture

- Affordable housing

Patamar invests in early stage companies within the industries listed above that we refer to as our investment themes.

Implementation

- Due diligence (audit) of impact pre-investment

- Measurement of impact post-investment

- Accountability and continuous improvement of the impact assessment process

Our impact investment strategy is implemented through a framework, built to ensure that the impact mandate is executed independently of any biases of the objective of financial gains.

Investment themes

- Financial inclusion

- SME digitization

- Education

- Healthcare

- Agriculture

- Affordable housing

Patamar invests in early stage companies within the industries listed above that we refer to as our investment themes.

Impact goals

Access to and the use of responsible financial services for historically underserved people.

Improving financial health.

Improving rural economies through financial inclusion.

Increasing gender equality through financial inclusion.

Improving earnings and wealth through employment and entrepreneurship (particularly for disadvantaged and excluded groups).

Impact goals

Access to and the use of responsible financial services for historically underserved people.

Improving financial health.

Improving rural economies through financial inclusion.

Increasing gender equality through financial inclusion.

Improving earnings and wealth through employment and entrepreneurship (particularly for disadvantaged and excluded groups).

We’ve aligned our six investment themes to the Global Impact Investing Network (GIIN) and IRIS+, which was used to identity Patamar’s five impact goals.

By achieving our impact goals. we inch closer to addressing the UN SDGs and the 2X Challenge.

We’ve aligned our six investment themes to the Global Impact Investing Network (GIIN) and IRIS+, which was used to identity Patamar’s five impact goals.

By achieving our impact goals. we inch closer to addressing the UN SDGs and the 2X Challenge.

Implementation

- Due diligence (audit) of impact pre-investment

- Measurement of impact post-investment

- Accountability and continuous improvement of the impact assessment process

Patamar invests in early stage companies within the industries listed above that we refer to as our investment themes.

We’ve aligned our six investment themes to the Global Impact Investing Network (GIIN) and IRIS+, which was used to identity Patamar’s five impact goals.

By achieving our impact goals. we inch closer to addressing the UN SDGs and the 2X Challenge.

Our impact investment strategy is implemented through a framework, built to ensure that the impact mandate is executed independently of any biases of the objective of financial gains.

Our impact investment strategy is implemented through a framework, built to ensure that the impact mandate is executed independently of any biases of the objective of financial gains.

Our impact in numbers

Over 10 years

10+ million

lives impacted

(across current active portfolio companies)

Over 10 years

USD 90.2 million

impact investments

(across all Patamar funds)

Unbanked beneficiaries served

Female beneficiaries reached

Blue-collar workers engaged

Jobs supported

Farmers served

Loans disbursed

Low-income borrowers

MSMEs/SMEs served

Unbanked beneficiaries served

Female beneficiaries reached

Blue-collar workers engaged

Jobs

supported

Farmers

served

Loans

disbursed

Low-income borrowers

MSMEs/SMEs served

Unbanked beneficiaries served

Female beneficiaries reached

Blue-collar workers engaged

Jobs

supported

Farmers served

Loans disbursed

Low income borrowers

MSMEs/SMEs served